Making the case for an integrated budgeting tool for Venmo business accounts that helps users manage income, forecast payments, and set financial goals, reducing reliance on external tools. This feature encourages users who currently accept Venmo through personal profiles to switch to business accounts, streamlining their finances and boosting Venmo's profits through increased adoption and transaction volume.

Venmo Business Account Budgeting Tool

Overview

Role: UX Designer

Sector: Finance

Tools: Figma, Google Surveys, Venmo Analytics, Maze

Focus: Market Research, User Interviews, User Testing, Prototyping

Opportunities to increase Venmo Business Account adoption

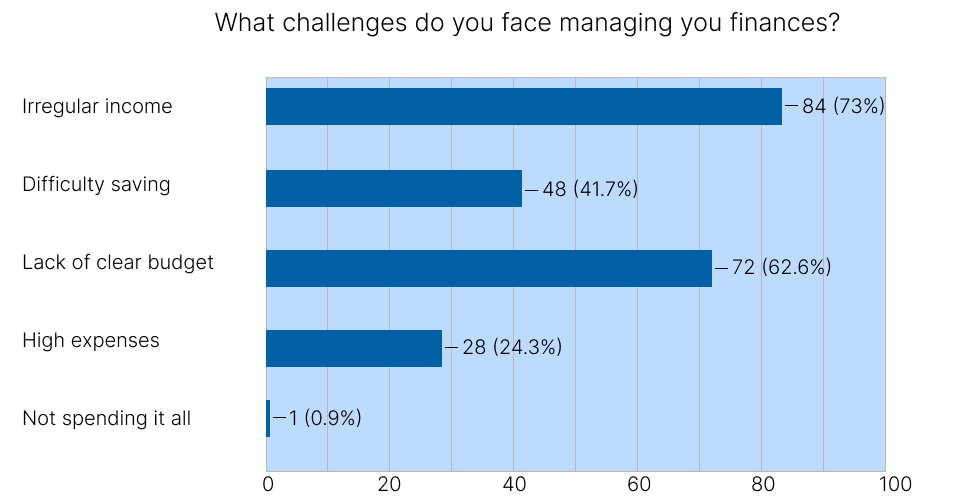

Venmo is a leader in mobile payments, with 82 million users, a 38% market share in digital transactions, and acceptance by over 2 million merchants. Despite this, initial research reveals growth opportunities, particularly among self-employed users who accept Venmo but have yet to transition to Venmo Business accounts. My survey of 115 self-employed users highlights a striking insight:

Business Accounts Drive Venmo’s Revenue

Venmo business accounts charge an average transaction fee of 1.9%. In this research, we can see a relatively low adoption of Venmo’s business account feature, leading to lost revenue opportunities. This suggests that many users who could benefit from business accounts aren't making the switch.

What pain points are users experiencing and how can we address them to encourage a transition to business accounts?

Hypothesis: Help Users Budget

I hypothesize that many self-employed individuals face challenges managing their income and budgeting due to irregular pay schedules and unpredictable expenses. This financial inconsistency can make it difficult to stay organized and meet goals. By providing tools that streamline income tracking and automate budgeting, users can better manage their finances, reduce stress, and achieve greater financial stability.

Early Findings

The survey indicates that 86% of users who currently use personal accounts to accept Venmo payments would consider switching to a Venmo Business account if it included an integrated budgeting tool.

Key Question

“Current Venmo Users: would you consider switching from a personal account to a business account if it had an integrated budgeting tool?”

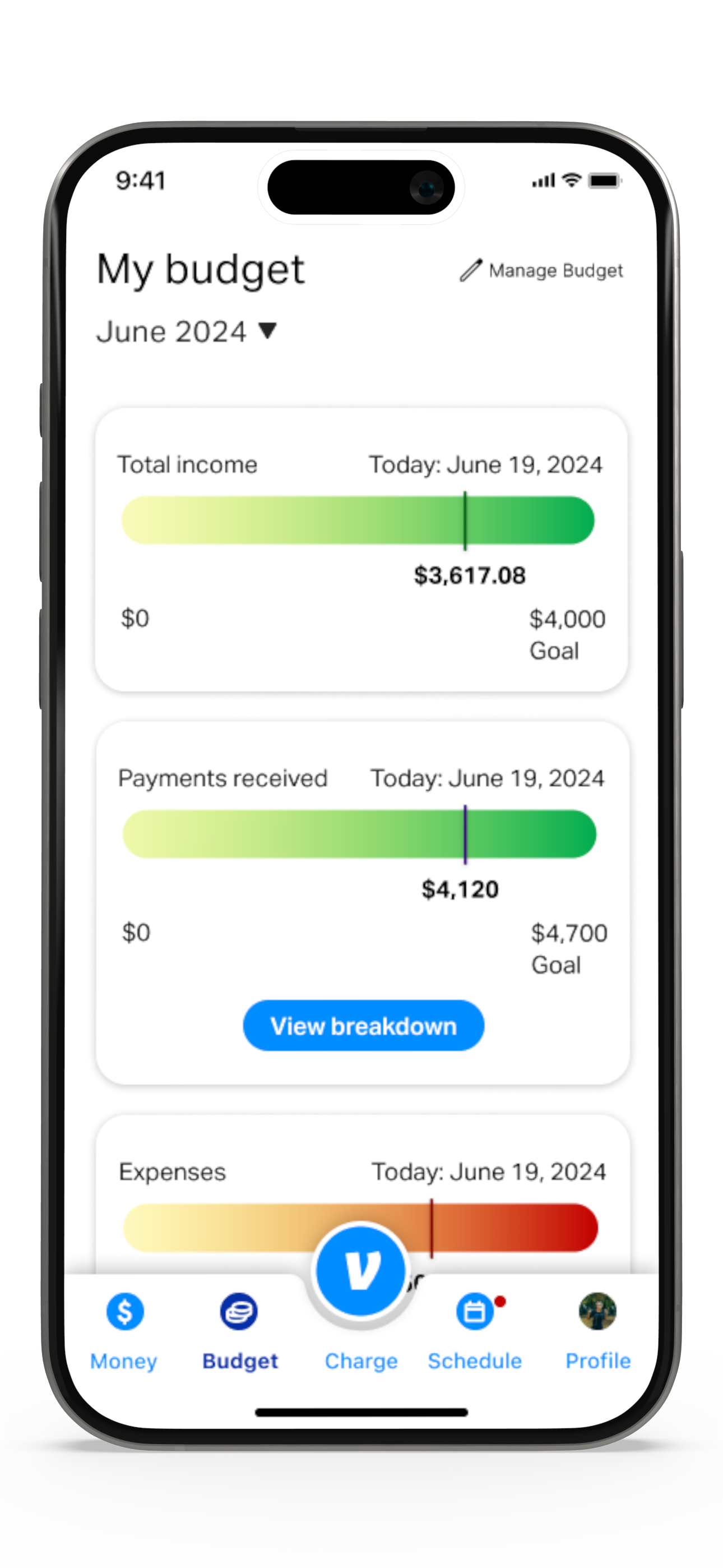

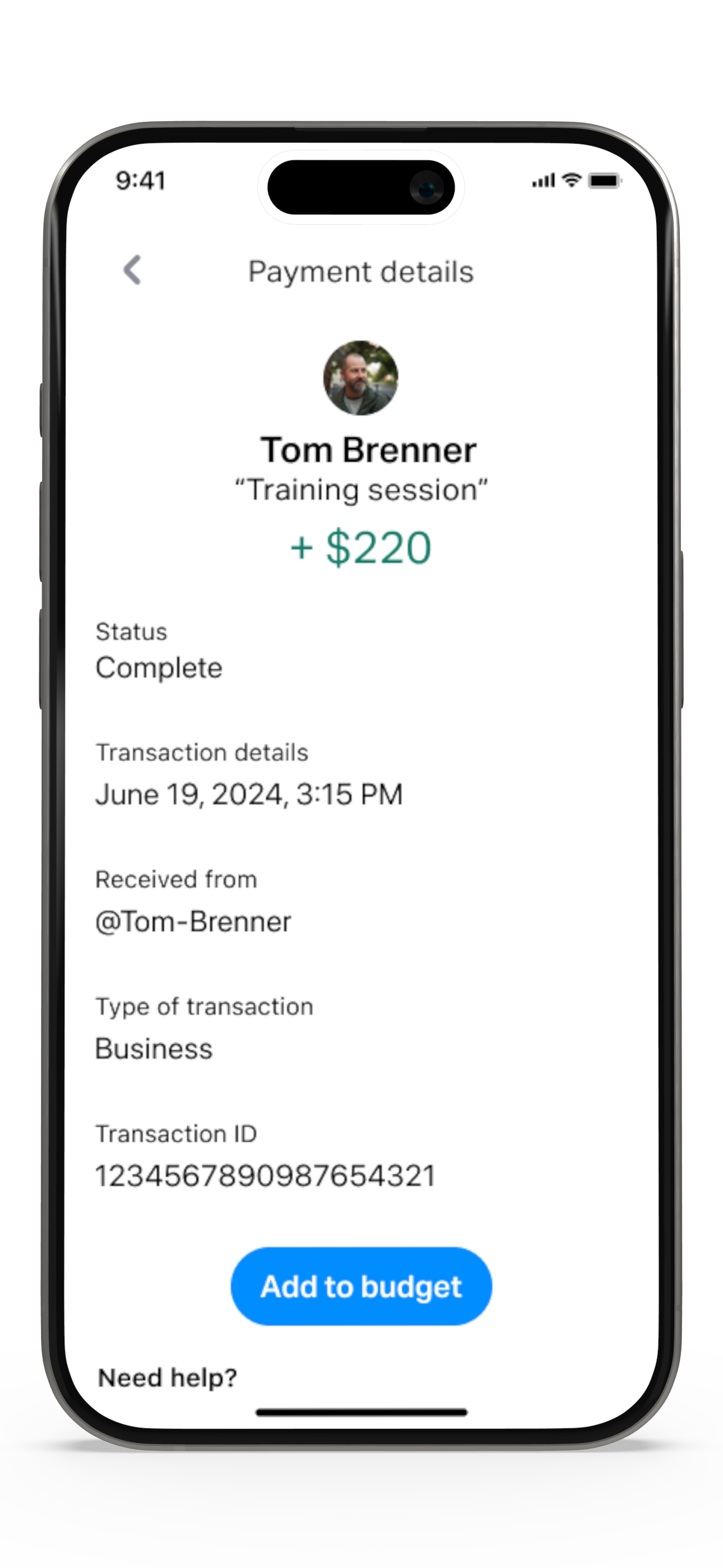

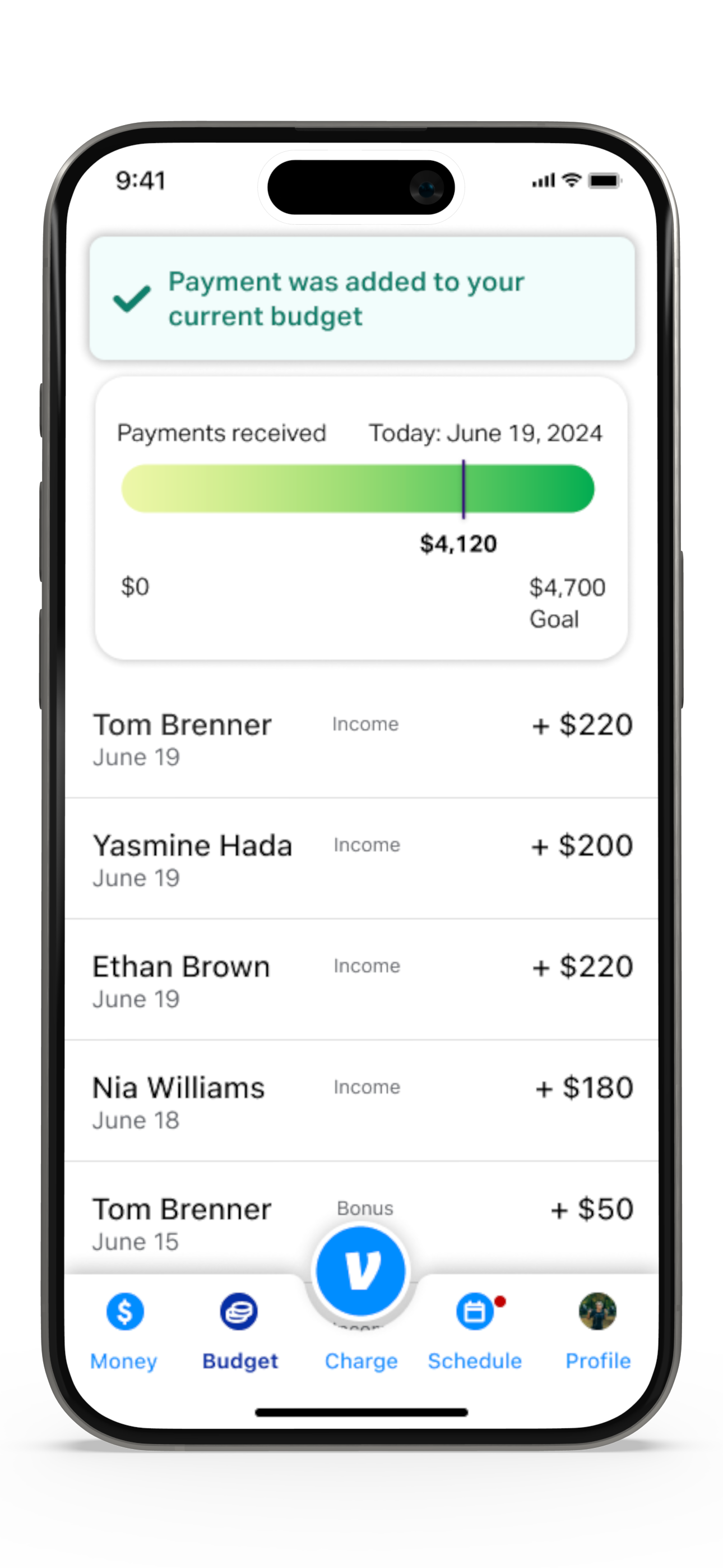

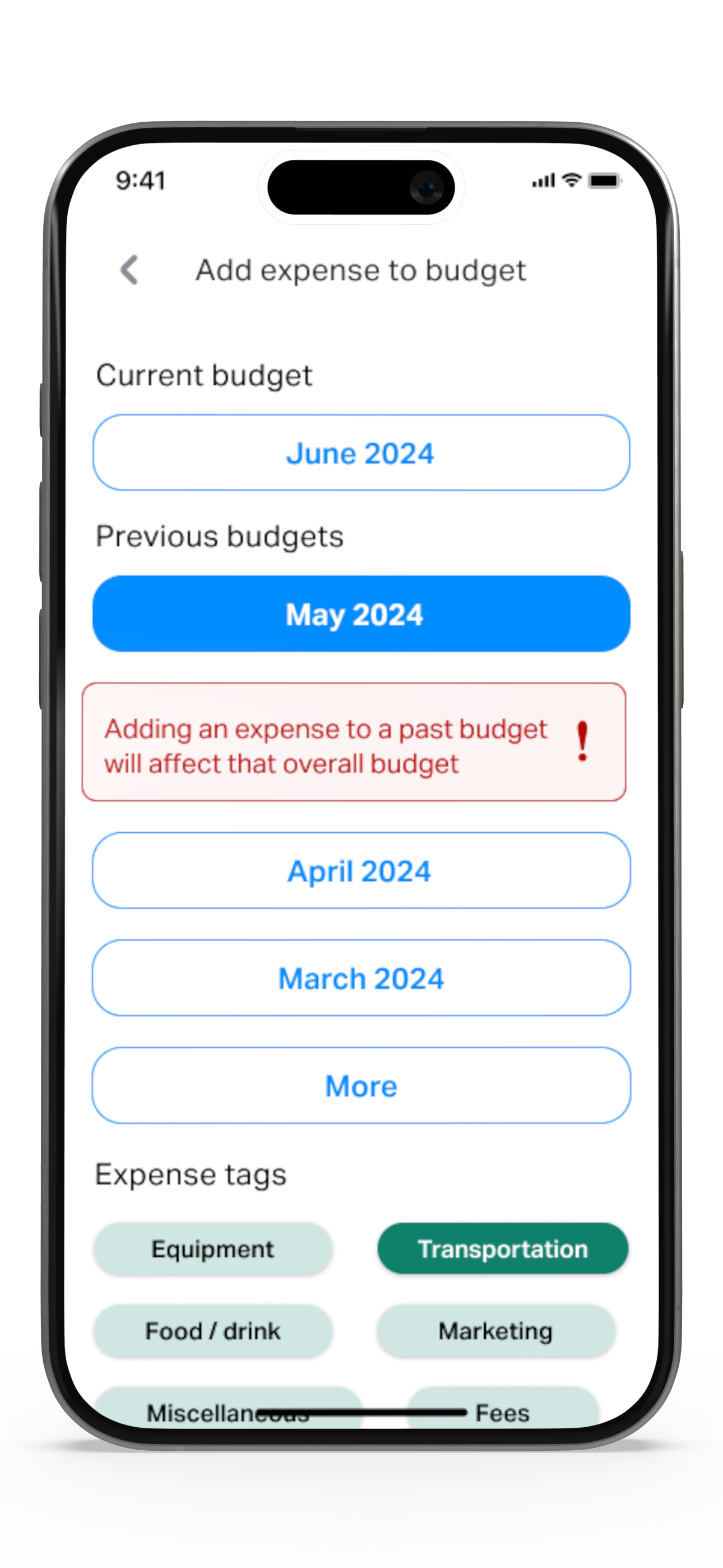

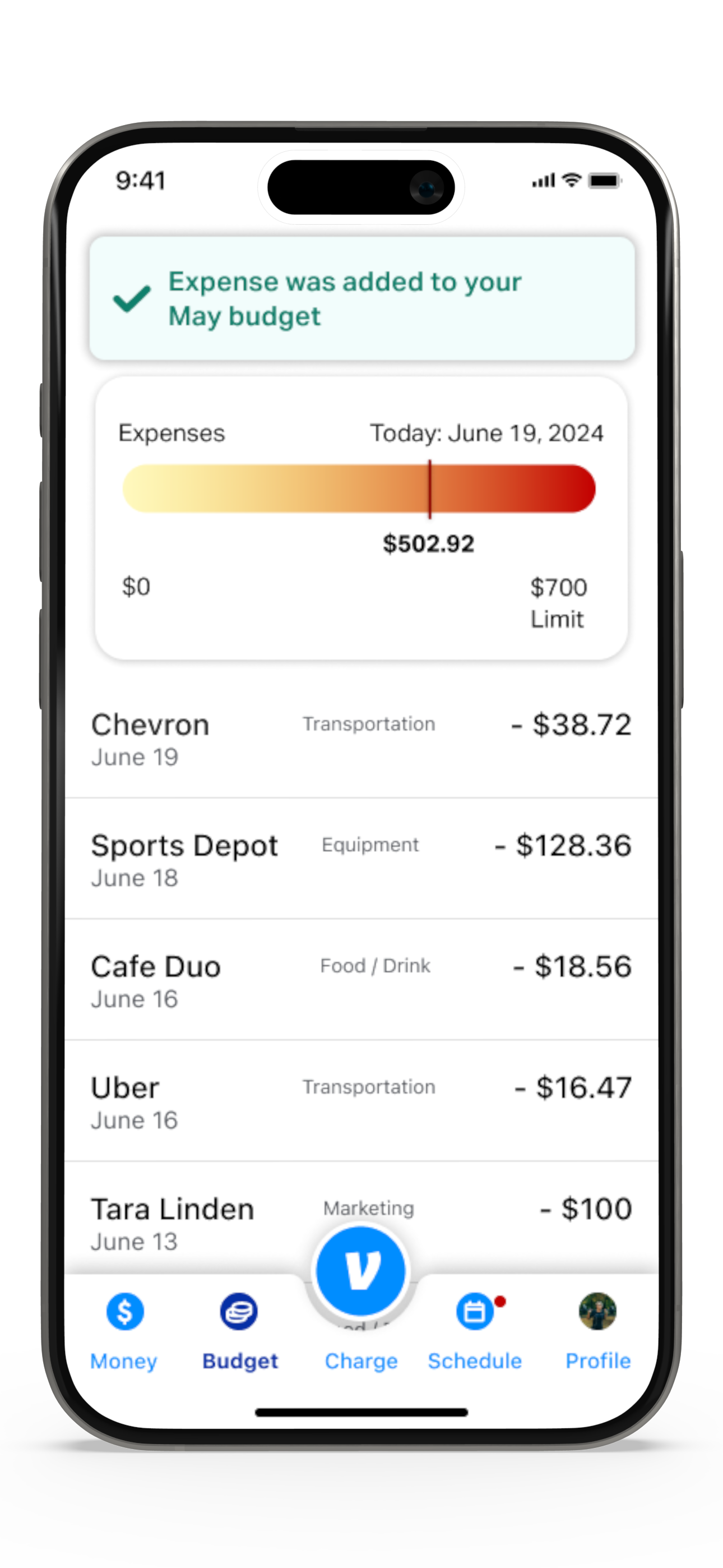

Sneak Peek at solutions

Research Breakdown

Surveys & Interviews

Purpose & process: To assess what tools and methods self-employed users currently use for budgeting and managing their business finances to better understand gaps and opportunities for an integrated Venmo Business budgeting feature.

Survey Snapshots

Interview Snapshots

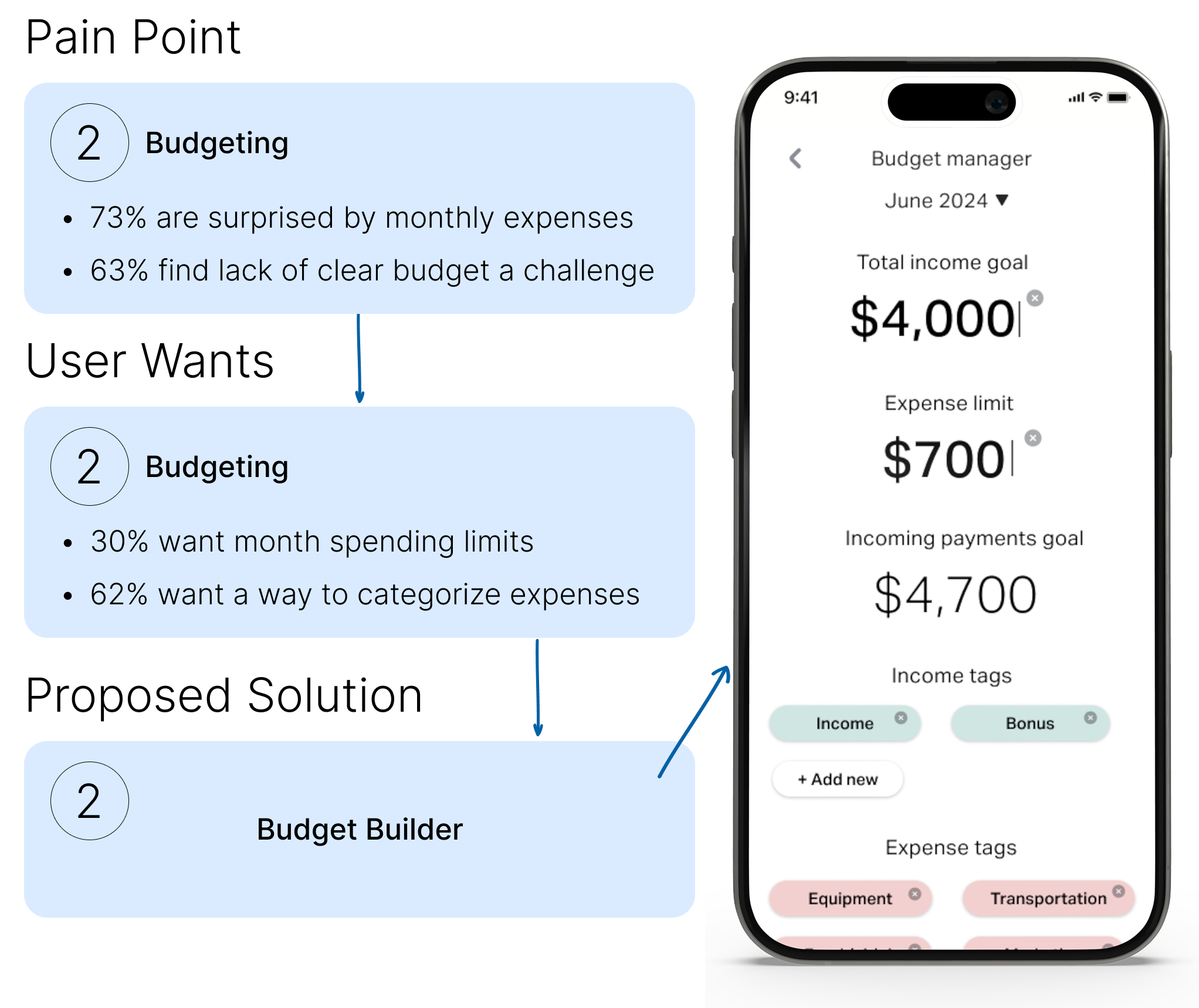

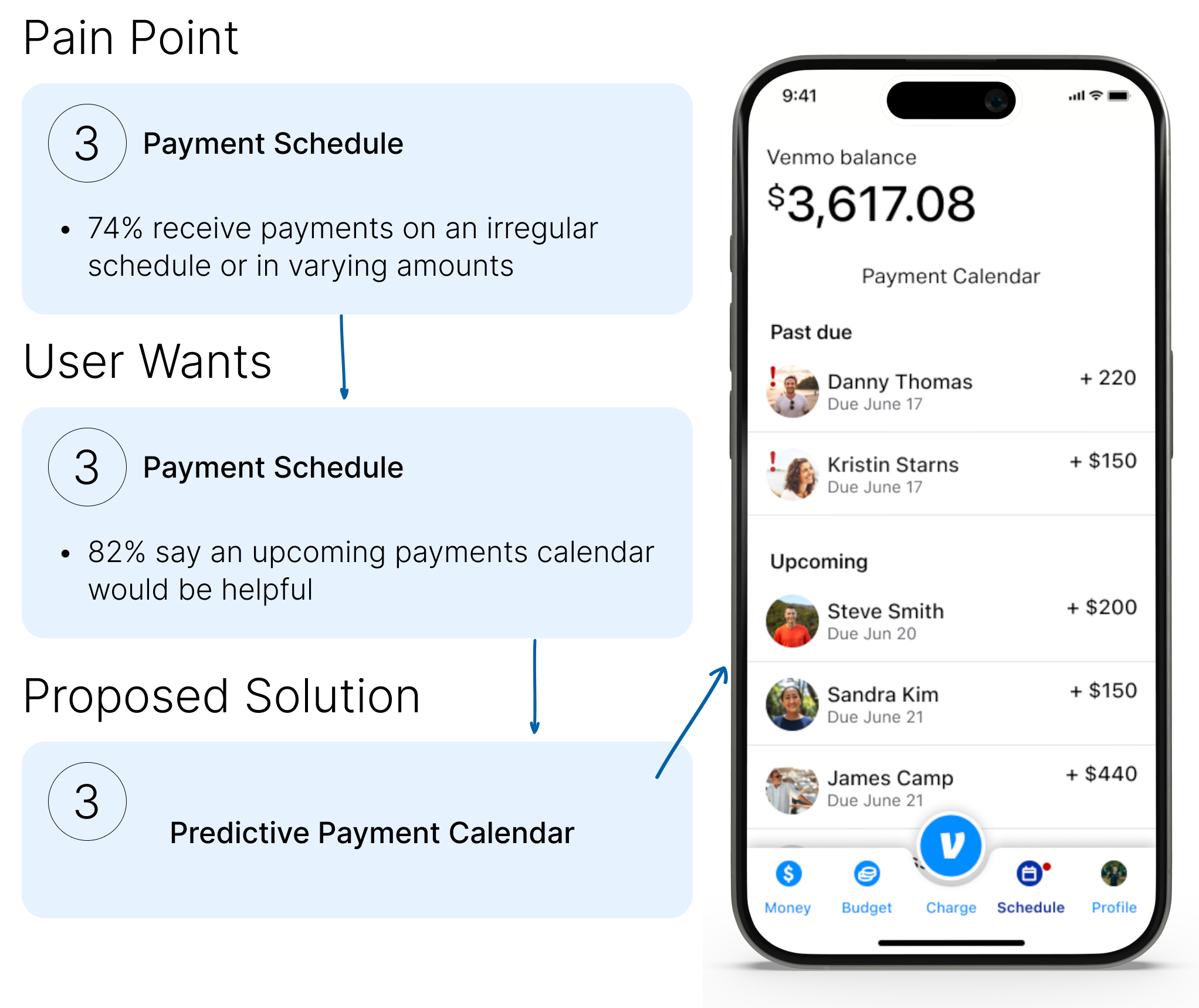

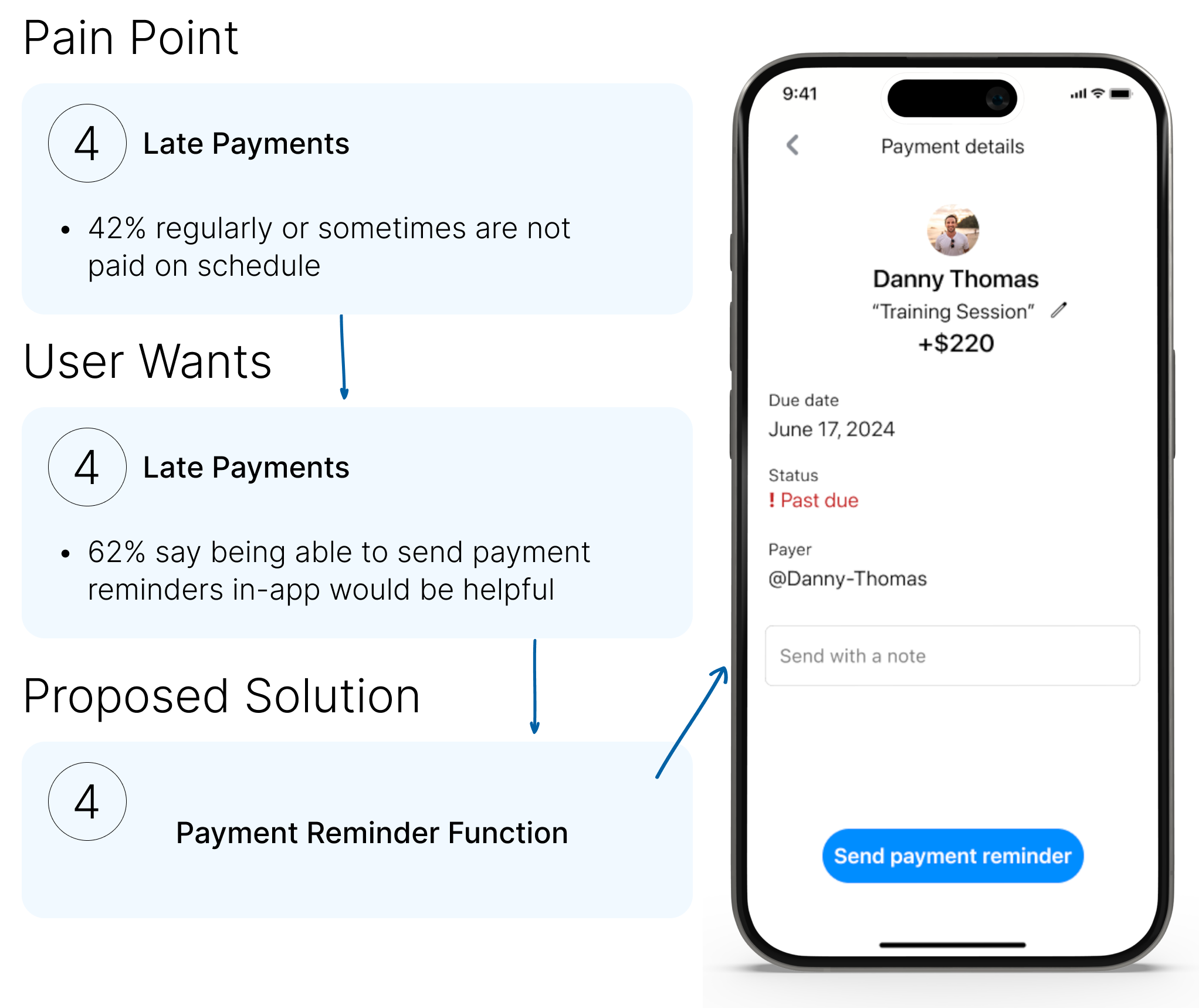

Feature Ideation

Identifying & Proposing 4 Key Features

Wireframes, Testing, & Iteration

User Testing Round 1

Purpose & process: Assess usability, identify pain points, and assess whether or not the proposed tools are helpful. Tasks included

locating their budget

finding the payment schedule

sending a past-due payment reminder.

Users were also encouraged to explore the budgeting tool freely and provide open-ended feedback.

Demographic: Eight users who identify as currently self-employed. Users included:

5 who provide services (e.g., personal trainers)

1 who sell products

2 in entertainment

Round 1 Key Takeaways

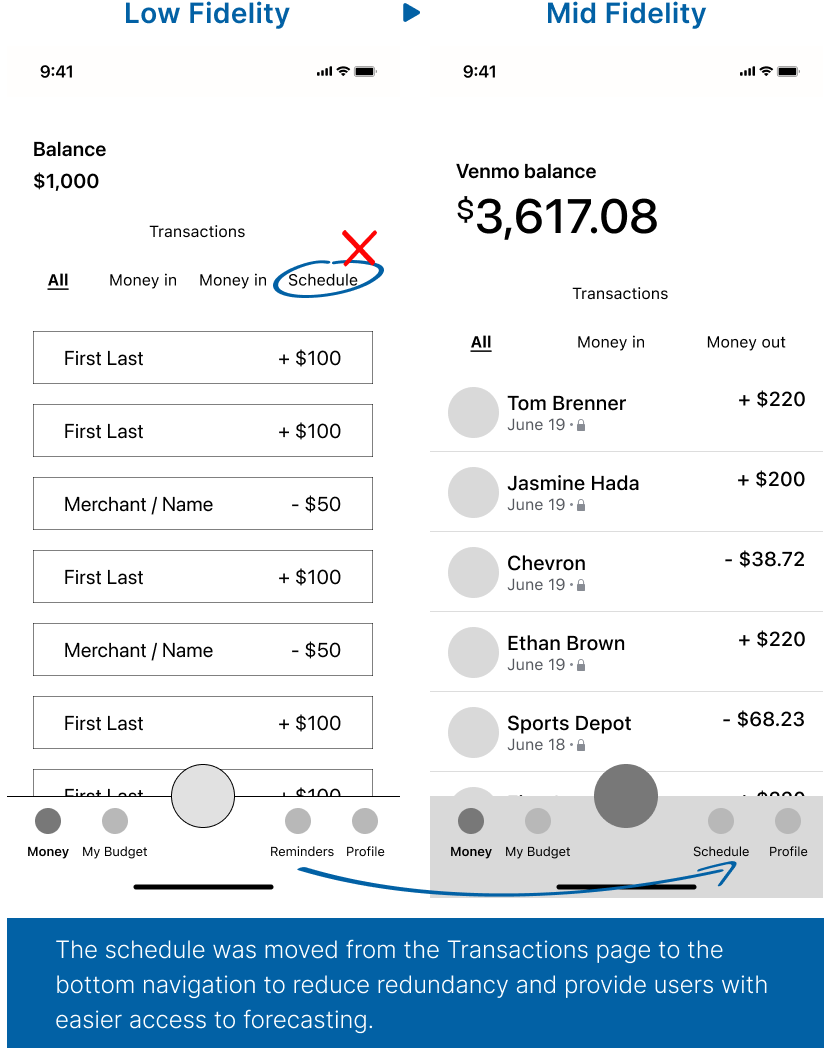

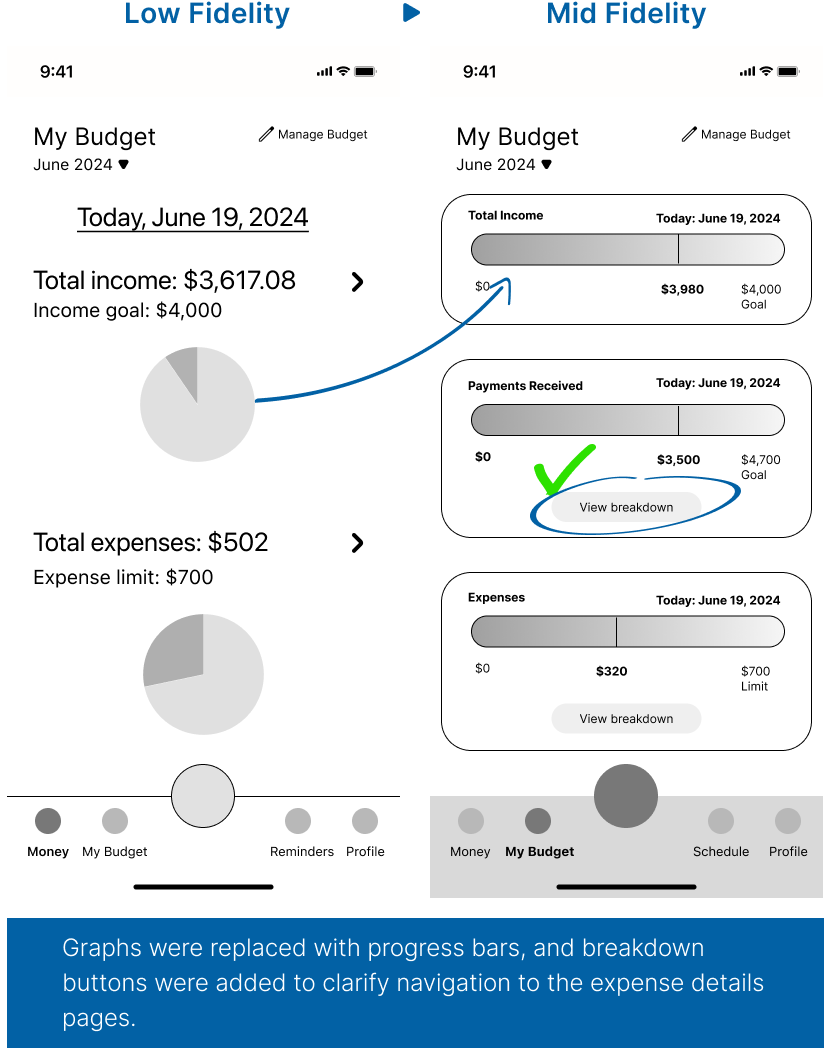

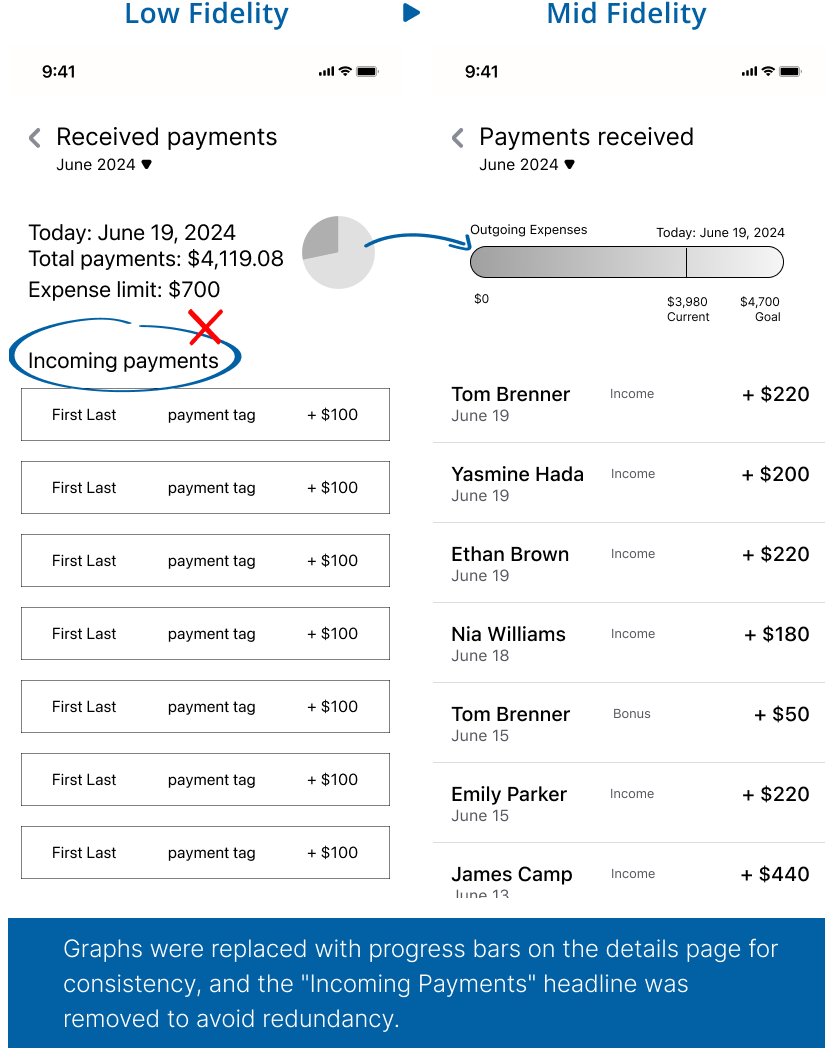

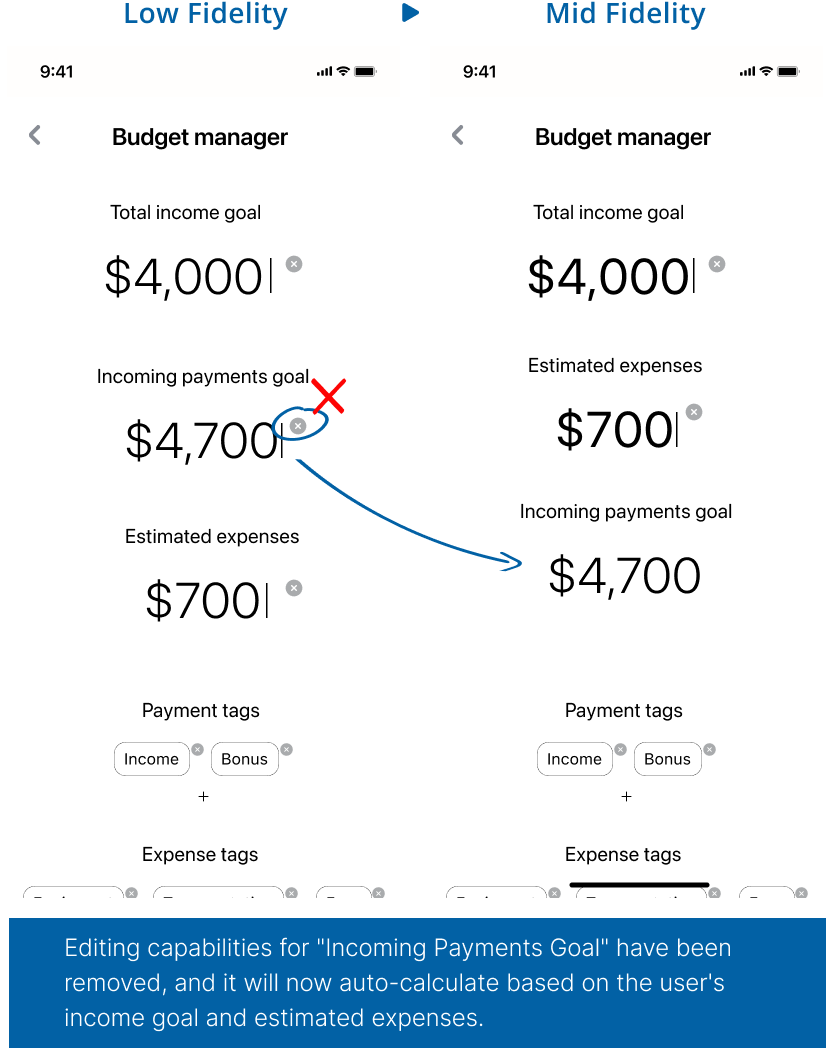

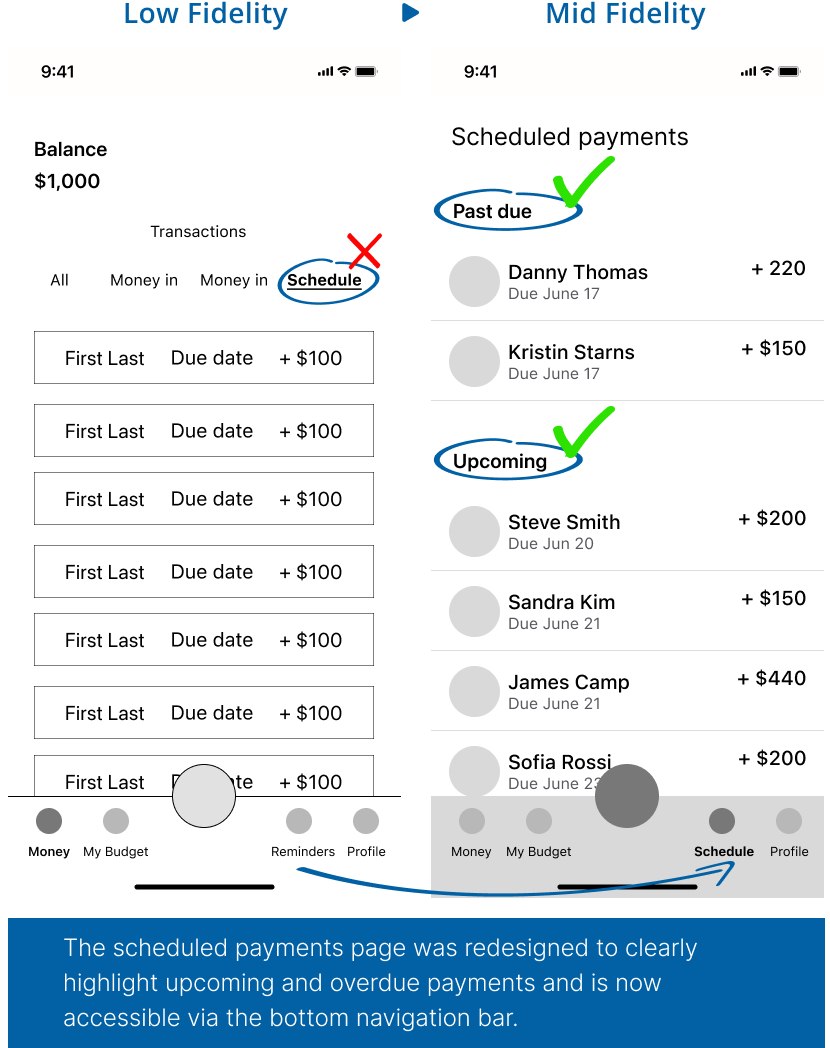

Select Low Fidelity Iterations

User Testing Round 2

Purpose & process: refining the prototype by evaluating updates made after the initial feedback. Additionally, more detailed feedback on the overall experience, assessing whether users find the tool intuitive and whether additional adjustments are needed before finalizing the design.

Goal: ensure the changes have improved usability, verify that previously identified pain points are resolved, and test new features for ease of use.

Round 2 Key Takeaways

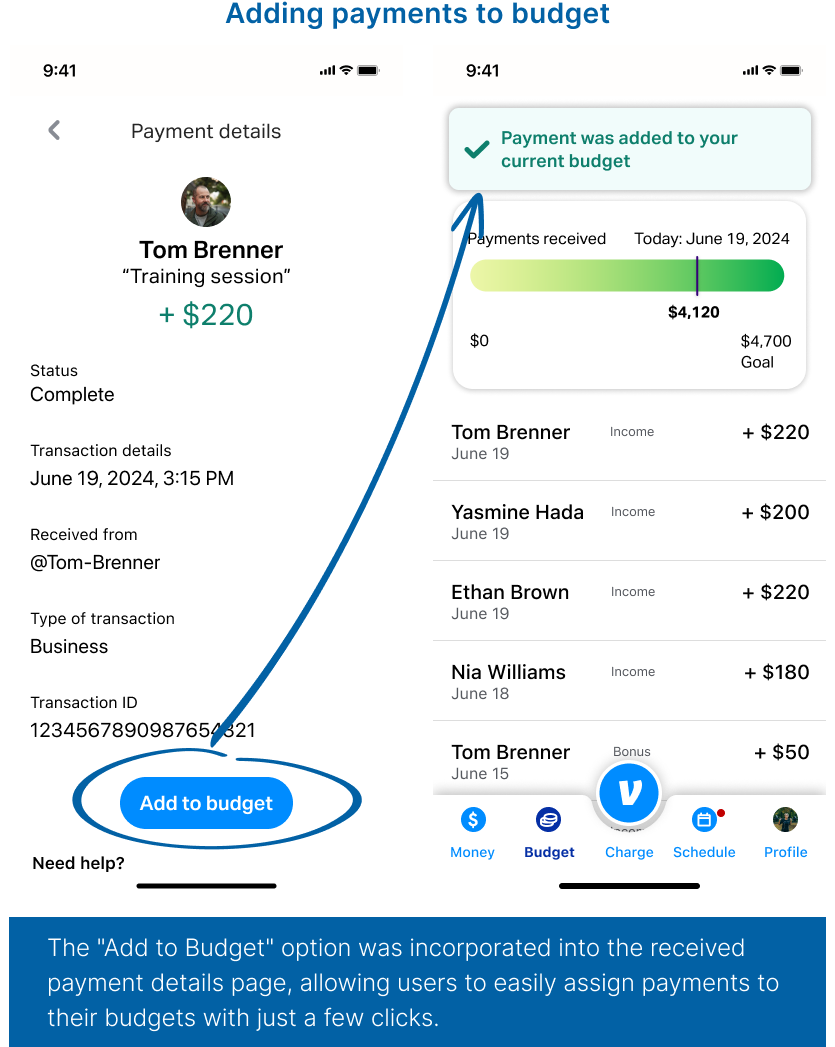

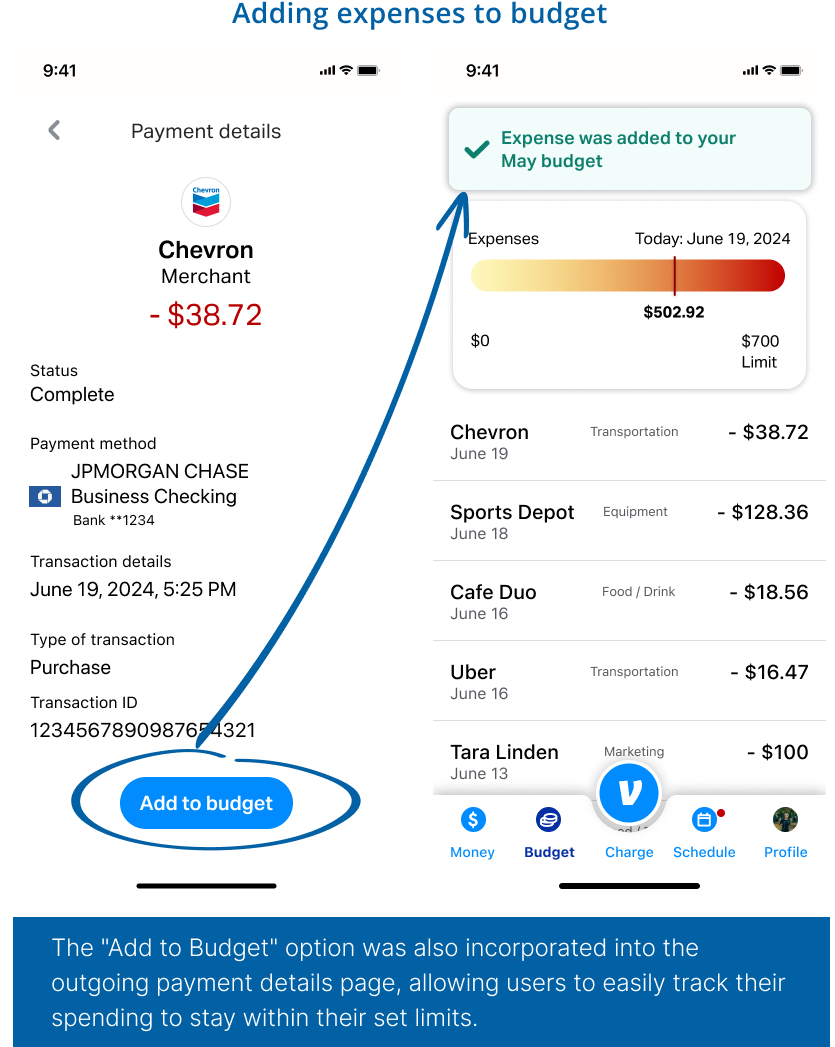

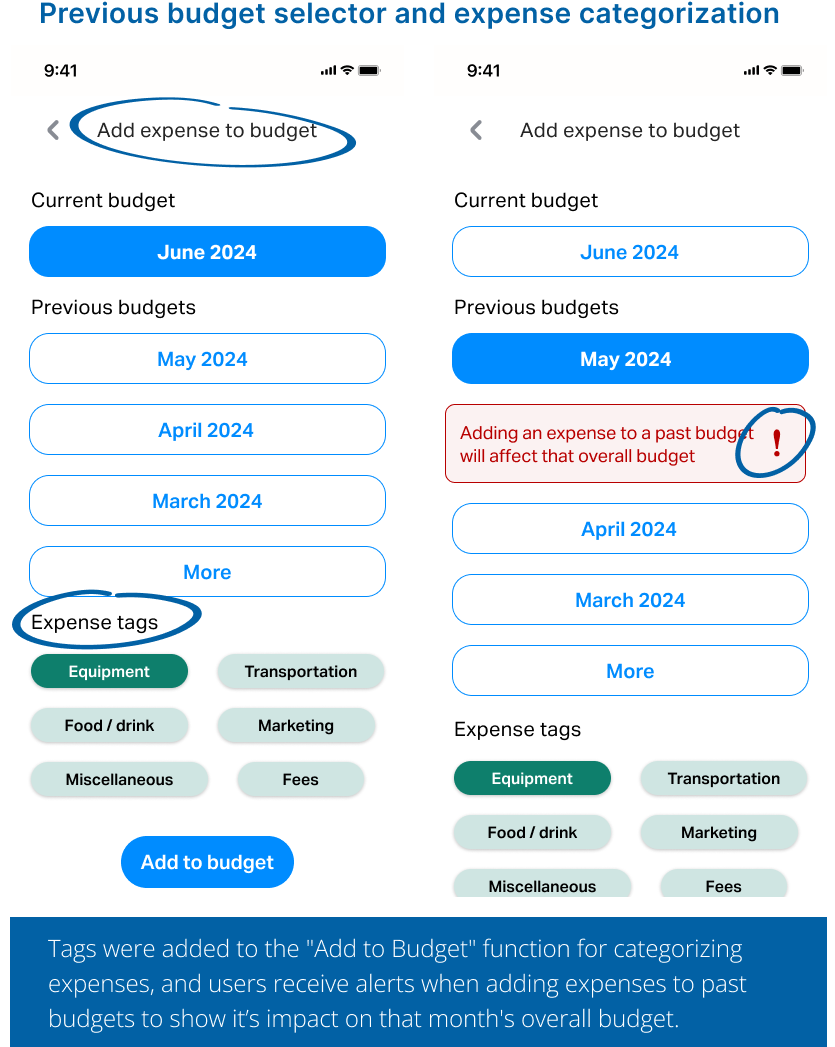

Final Tool Features & Functionalities

Integration Into Venmo’s Existing Design

Toggle view of balance summary

The "Money" page redesigned, allowing users to toggle between incoming and outgoing payments, offering a clear, at-a-glance view of balances. Add and Transfer were moved to settings.

Easy access to key features

The navigation bar was updated to seamlessly integrate the new budgeting and payment calendar features, ensuring that the two most requested features are easily accessible for users.

High Fidelity Prototype

Next Steps

Integrated Income Tax Calculator

Annual Budgeting Tool

An annual budget tool complements a monthly one by providing a long-term financial view, helping users plan for seasonal income changes and larger expenses. It ensures better preparation for irregular costs, making it easier to achieve bigger financial goals and maintain overall stability. Including a long-term budget would also aid in user retention.

Tax season can be particularly stressful for self-employed users due to the complexity of managing irregular income and tracking deductible expenses. An integrated tax estimator would be incredibly beneficial by helping users automatically calculate their estimated taxes based on their income and expenses throughout the year. This tool would not only reduce stress but also improve financial planning, ensuring users are better prepared for tax payments and can avoid surprises when tax deadlines approach.